The patience premium: What market history teaches us

“How long will this last?”

“Will markets bounce back?”

“Should I make a change now?”

These are some of the most common and understandable questions investors are asking right now. When the market takes a sharp turn, it’s only natural to wonder what comes next and how long it might take to feel confident in the markets and economy again.

Let’s start with where we are today.

Over the past two months, markets have fallen sharply. The S&P 500 is down more than 17% from its February highs, while the Dow has dropped over 7,000 points.

What’s driving the decline? It’s not one thing. It’s a mix of economic and political uncertainty.

Heightened trade tensions, aggressive new tariffs, public pressure on the Federal Reserve, and ambiguity around future rate cuts have all contributed. That cocktail of risk has pushed investors to the sidelines and sent volatility soaring.

But what everyone wants to know is, “When will things turn around?”

Of course, I don’t have a crystal ball. And you’ve heard this more than a few times before, but it’s worth repeating: past performance doesn’t guarantee future results. Markets don’t always follow historical patterns, and downturns can deepen before recovery begins. Still, looking at long-term data can offer some much-needed context and perspective.

For starters, markets tend to fall fast.

Historically, based on data from over a century of S&P 500 returns, adjusted for inflation and including dividends, it has taken as little as six months for a 20% decline to reach its bottom. Even deeper drops, like 40% or 50%, have often found their low point in under two years.1

But getting back to where we started? That takes longer. Much longer.

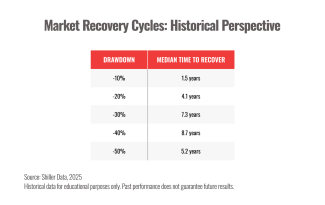

On average, a 20% drop has historically taken about four years to recover. A 30% decline stretches to over seven years. A 40% drawdown? Nearly nine.2

These numbers reflect the real emotional challenge of investing, not just the drop itself, but the long, patient climb back to previous highs.

In other words, recoveries are less like flipping a switch and more like repairing a home after a storm. The damage can be done quickly, but rebuilding confidence, earnings, and momentum takes time.

I’ll admit, it can be surprising how long it can take for markets to fully recover.

Since the end of the Great Financial Crisis, we’ve been fortunate. U.S. markets have generally bounced back quickly from declines, sometimes in just months. That kind of speed can create a false sense of how recoveries typically work.

But when you zoom out and look at a broader stretch of market history, it becomes clear that fast recoveries are the exception, not the rule.

Over nearly a century of S&P 500 data, the pattern is clear. Deep declines often take years, not months, to fully heal. And for investors who have only experienced the post-2008 era, this longer timeline can feel unexpectedly drawn out.

That said, there is reason to remain encouraged.

Historically, some of the strongest returns have come after the most difficult periods. Following the 10 worst calendar years since 1975, the S&P 500 delivered an average return of 17.5% one year later, compared to its average one-year return of 9.7% over the same broader time frame.

Over longer periods, the results are even more striking: an average 56% return after three years, and more than 200% after ten.3

Now I know you’ve heard this several times already, but here it is again: Past performance doesn’t guarantee future results. Markets don’t move in straight lines, and downturns can deepen before a recovery begins. Still, history provides helpful context, and it reminds us that long-term discipline has often been rewarded.

So what can you do right now?

Here are a few time-tested best practices we apply on behalf of our clients when markets turn volatile:

- Hunt for pockets of value: Look for areas of the market that may be undervalued or overlooked, where long-term potential outweighs short-term noise.

- Keep a diversified portfolio: Spreading investments across regions, sectors, and asset classes reduces your exposure to any single area.

- Avoid trying to time the market: Staying invested through downturns can yield better results than jumping in and out based on emotion.

- Rebalance when needed: Adjusting your mix of stocks and bonds can help manage risk and keep your plan aligned with your goals.

- Consider downside protection: In some cases, alternative strategies or specific investment products can help buffer volatility.

We can’t avoid market declines, but we can prepare for them, navigate through them, and stay focused on long-term outcomes.

Sources:

1. Shiller Data, 2025 [URL: https://shillerdata.com/]

2. Shiller Data, 2025 [URL: https://shillerdata.com/]

3. Market Declines: A History of Recoveries, 2025 [URL: https://www.mfs.com/content/dam/mfs-enterprise/mfscom/sales-tools/sales-ideas/mfse_resdwn_fly.pdf]

Chart sources:

Shiller Data, 2025 [URL: https://shillerdata.com/]

These views are those of the author, not of the broker-dealer or its affiliates. This material contains an assessment of the market and economic environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. All investments involve risk, including loss of principal. Forward-looking statements are subject to certain risks and uncertainties. Actual results, performance, or achievements may differ materially from those expressed or implied. Information is based on data gathered from what we believe are reliable sources.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors.

All indexes referenced are unmanaged. The volatility of indexes could be materially different from that of a client’s portfolio. Unmanaged index returns do not reflect fees, expenses, or sales charges. You cannot invest directly in an index. Consult your financial professional before making any investment decision.

No investment strategy can guarantee a profit or protect against loss in periods of declining values. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.